📖 Method of simulated moments (MSM) for model estimation#

⏱ | words

Next step after solver and simulator are debugged#

Estimate model parameters from simulated data?

study the implications of theoretical assumptions of various models and theories

run numerical simulations of optimal decisions and policies (for particular values or ranges of values of model parameters)

But the ultimate goal is to match the model to the actually observed data, and:

quantify of the effects of various parts of the theoretical setup

perform counterfactual experiments simulating the behavior of the decision maker in hypothetical policy regimes

support or falsify theoretical results by examining their fit to the observed data

Estimation vs. calibration#

What is the difference? Sometimes the terms are used interchangeably

Standard errors of estimates (measure of variability of the estimation results)

Study of identification (to make sure that only a single parameter values can maximize the statistical criterion and explain the data)

Calibration exercises often skip these steps, even if employing algorithmic search of best parameters to fit the model to the data.

Applications of estimation sometimes estimate only a subset of parameters, treating other as fixed, similar to calibration with parameter values from the literature.

Workflow of structural estimation#

Theoretical model development (what is of interest?)

Practical specification/implementation issues

Solving the model (method + implementation in the code)

Understanding how the model works

Estimation: running the statistical procedure

Validation (assessing in-sample and out-of-sample performance)

Policy experiments, counterfactual simulations

Example

Stochastic consumption-savings model

solver to compute the optimal policy function for given parameter values

simulator to simulate data for given parameter values (and model solution)

Need:

estimation procedure to find the “best” parameter values to fit the model to the observed data

counterfactual simulation program to use the estimated model for policy experiments

Understanding how the model works#

Solve the model for a set of parameter values

Simulated data from the model

Does it make (economic) sense?

Repeat (many-many times)

may take a lot of time to convince yourself that the code does not have bugs

unexpected/surprising results still appear? Making research progress!

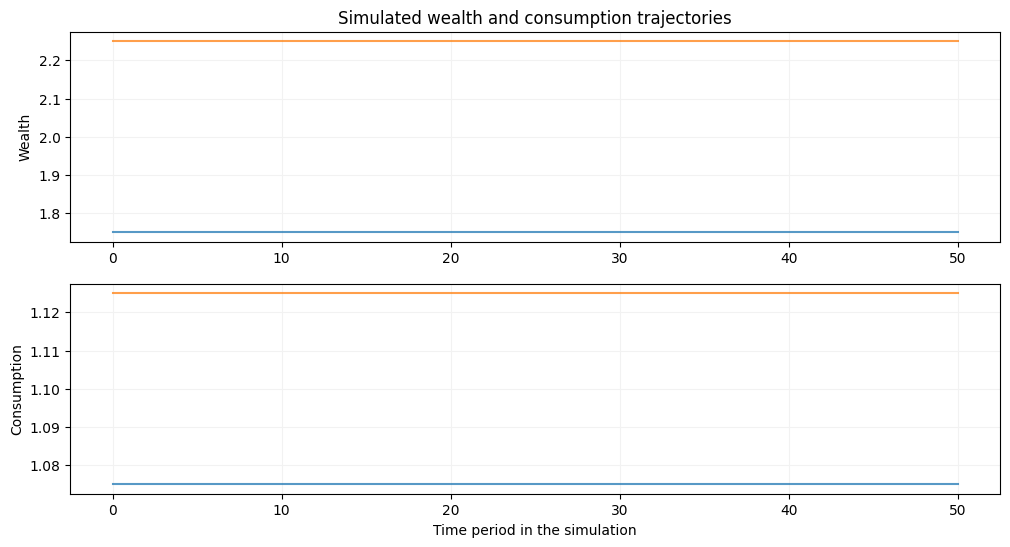

# deterministic model with βR=1 and y=1

m = deaton(beta=0.9,R=1/0.9,ngrid=100,nchgrid=250,sigma=1e-10,nquad=2)

m.solve_egm(tol=1e-10)

init_wealth, T = [1.75,2.25], 50

m.simulator(init_wealth=init_wealth,T=T,seed=2020)

plt.show()

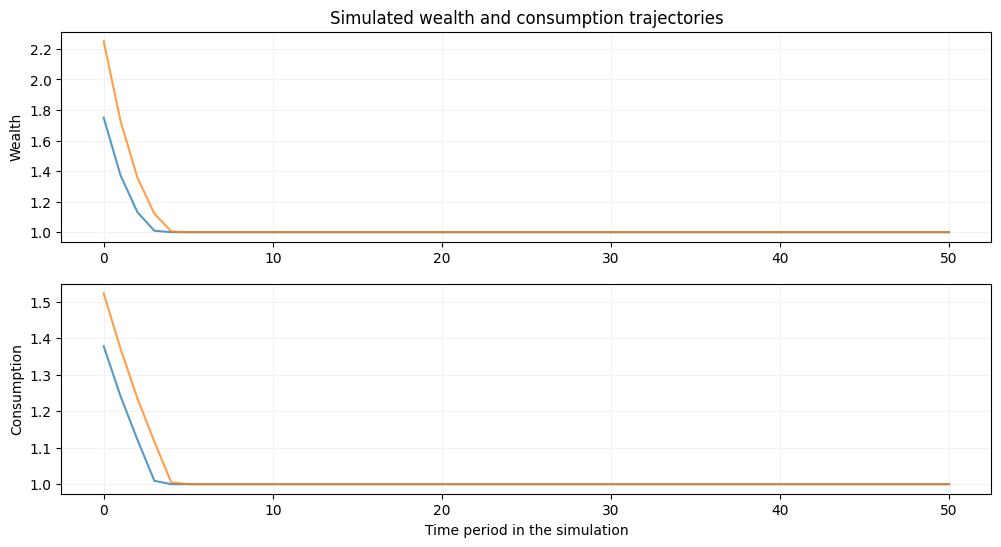

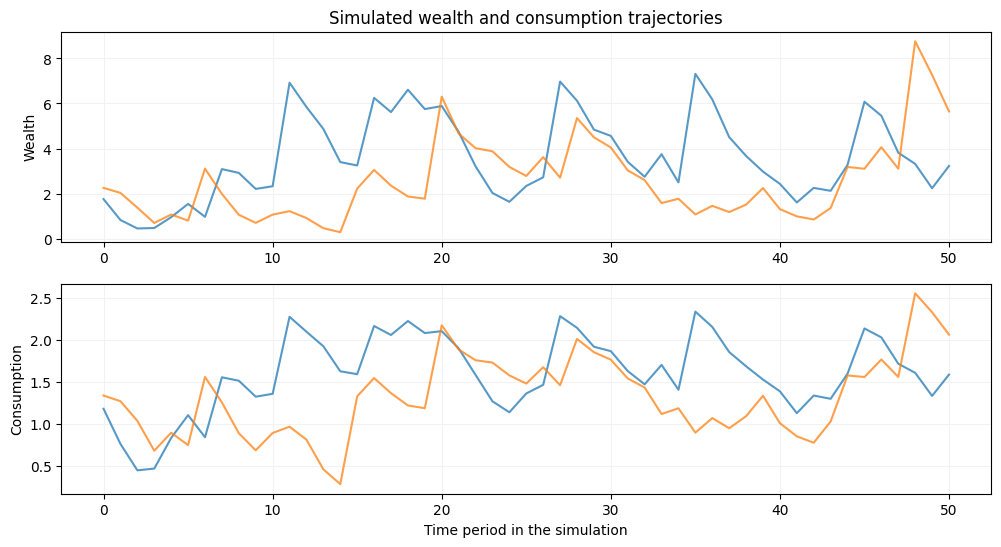

# deterministic model with R=1 and y=1

m = deaton(beta=0.9,R=1.0,ngrid=100,nchgrid=250,sigma=1e-10,nquad=2)

m.solve_egm(tol=1e-10)

init_wealth, T = [1.75,2.25], 50

m.simulator(init_wealth=init_wealth,T=T,seed=2020)

plt.show()

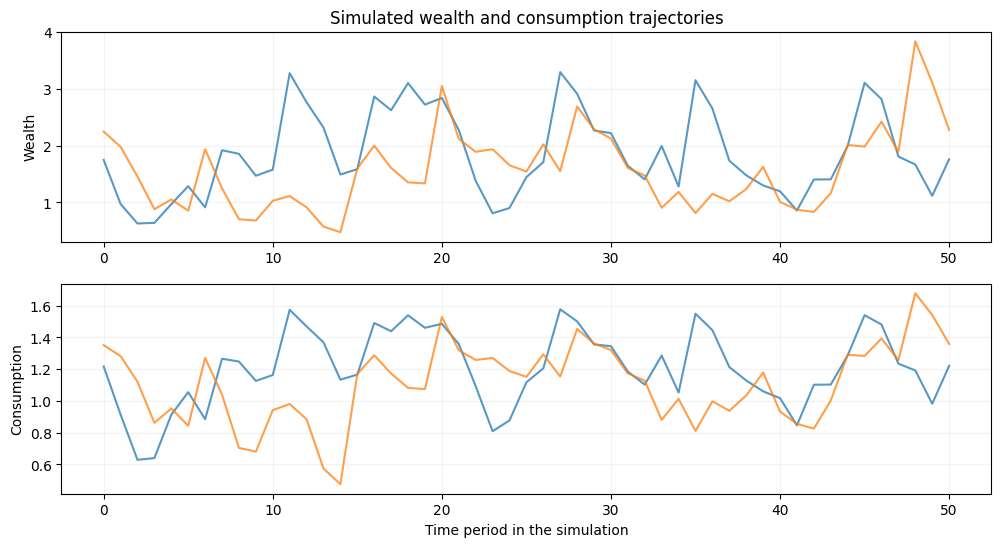

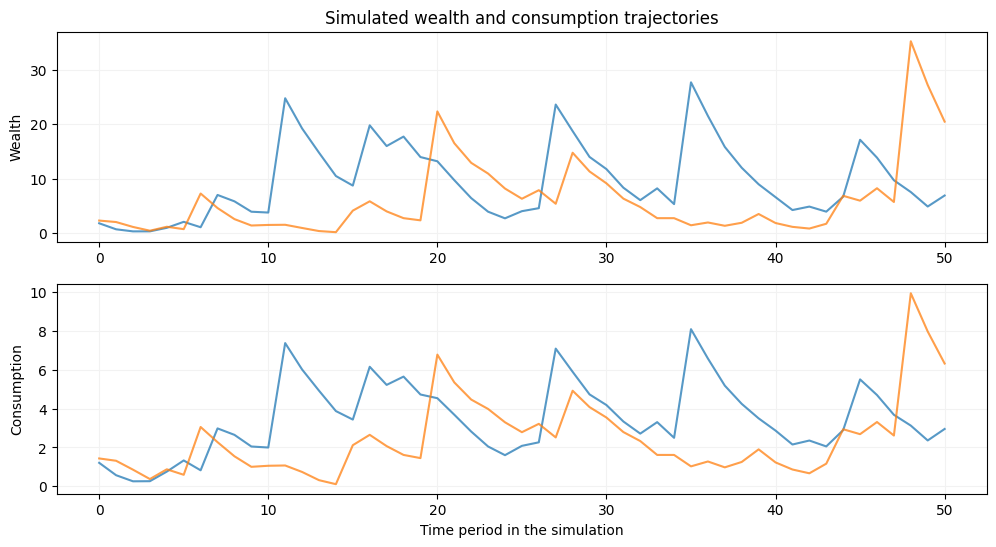

# two stochastic models with different income variance

m1 = deaton(beta=0.9,R=1.05,ngrid=100,nchgrid=250,sigma=0.5)

m2 = deaton(beta=0.9,R=1.05,ngrid=100,nchgrid=250,sigma=0.85)

m1.solve_egm(tol=1e-10)

m2.solve_egm(tol=1e-10)

init_wealth, T = [1.75,2.25], 50

m1.simulator(init_wealth=init_wealth,T=T,seed=2020)

m2.simulator(init_wealth=init_wealth,T=T,seed=2020)

plt.show()

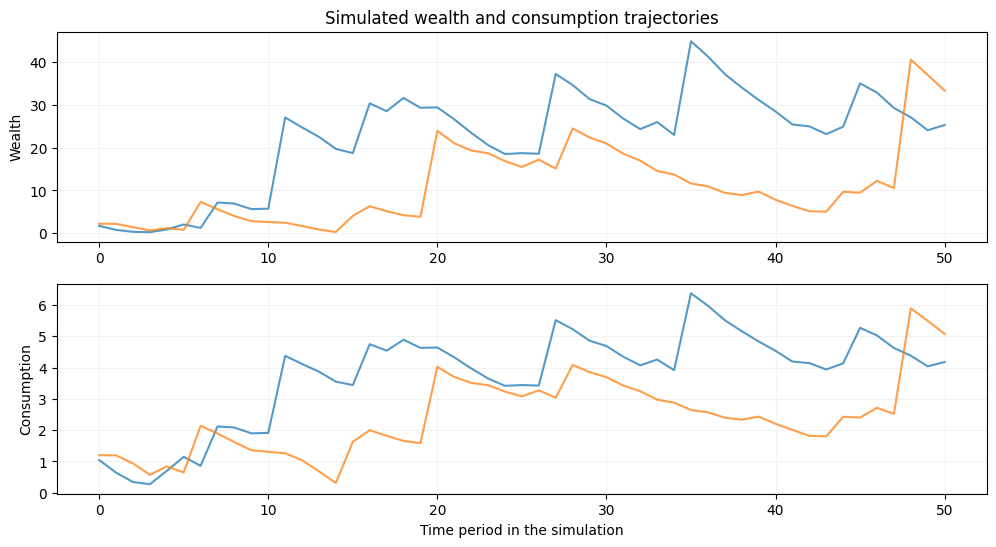

# two stochastic models with different dicount coefficients

m1 = deaton(beta=0.85,R=1.05,ngrid=100,nchgrid=250,sigma=1.5)

m2 = deaton(beta=0.95,R=1.05,ngrid=100,nchgrid=250,sigma=1.5)

m1.solve_egm(tol=1e-10)

m2.solve_egm(tol=1e-10)

init_wealth, T = [1.75,2.25], 50

m1.simulator(init_wealth=init_wealth,T=T,seed=2020)

m2.simulator(init_wealth=init_wealth,T=T,seed=2020)

plt.show()

Method of simulated moments#

we have seen how changing parameters is reflected in changes in the simulated wealth and consumption profiles

imagine we have data on observed consumption or wealth profiles for a sample of people, or even some aggregate data on consumption or wealth

then we can find parameters of the model that would induce the simulated data to reflect the observed profiles, or some descriptive statistics (moments) of these profiles

Simulated moments#

The idea of directly matching the moments from the model to the observed ones leads to the method of moments estimator

Method of moments: # of parameters = # of moments to match, system of equations

Generalized method of moments (GMM): # of parameters < # of moments, minimize the distance between the data moments and theoretical moments

Method of simulated moments (MSM): using simulations to compute the theoretical moments

Definition of MSM estimator#

\( \theta \in \Theta \) is parameter space

\( e(\tilde{x},x|\theta) \) is the row-vector of \( K \) moment conditions

\( W \) is the \( K \times K \) weighting matrix

\( x \) and \( \tilde{x} \) is observed and simulated data

Moments and moment conditions#

\( m^k(\cdot) \) is the \( k \)-th moment generating function

\( m^k(x) \) are empirical moments (computed from the observed data)

\( m^k(\tilde{x}|\theta) \) are the simulated moments (computed from the simulated data using parameter values \( \theta \))

Theory of MSM#

📖 McFadden [1989] “A method of simulated moments for estimation of discrete response models without numerical integration”, Econometrica

📖 Pakes and Pollard [1989] “Simulation and the Asymptotics of Optimization Estimators”, Econometrica

📖 Lee and Ingram [1991] “Simulation estimation of time-series models”, Journal of Econometrics

📖 Duffie and Singleton [1993] “Simulated moments estimation of Markov models of asset”, Econometrica

Statistical properties of MSM estimator#

\( \hat{\theta}_{MSM}(W) \) is consistent with any weighting matrix \( W \)

\( \hat{\theta}_{MSM}(W) \) is asymptotically normal \( \hat{\theta}_{MSM}(W) \sim N(0,\Sigma) \)

Variance-covariance matrix of the estimate#

\( W \) is weighting matrix

\( D = \partial e(\tilde{x},x|\theta) \big/ \partial \theta \) is the Jacobian matrix of moment conditions, computed at consistent estimate \( \theta \)

\( S \) is variance-covariance matrix of the moment conditions \( e(\tilde{x},x|\theta) \)

\( \hat{S} \) is estimate of \( S \), usually computed using simulations as well

\( \tau \) is the ratio of the simulated to empirical samples sizes

Optimal weighting matrix#

the asymptotic variance of the estimates is minimized when the weighting matrix is given by the inverse of the variance-covariance matrix of the moment conditions (at true value of the parameter)

the estimate of the variance-covariance matrix of the MSM estimate then becomes

weighting matrix can be estimated using the simulated analog

Weighting matrix in practice#

identity = in the first step of multi-step MSM estimations

diagonal weighting matrix, ignoring the covariances

manually chosen weights, i.e. to bring all the moments to the same scale

using sample variance to downgrade poorly measured empirical moments

estimated from the moment conditions based on first step consistent estimate

iteratively updated weighting using multi-step estimating procedure

Newey-West robust estimate of weighting matrix

additional model-specific adjustments

Many ways to skin a cat

Choice of moments#

crucial part for MSM estimation = being able to minimize the MSM criterion

more art than science

understanding how the model works = understanding what variation is induced in simulated data when parameters change

selected for estimation \( K \) moments should adequately represent this variation

Practical advantages of MSM#

not data hungry (may match aggregated moments)

allows to combine different sources of data

does not rely on the distributional assumptions as much as MLE

but lacks in efficiency, so standard errors are larger than MLE

weighting matrix is often simplified in practice due to small sample bias

Widely used method in applied research!

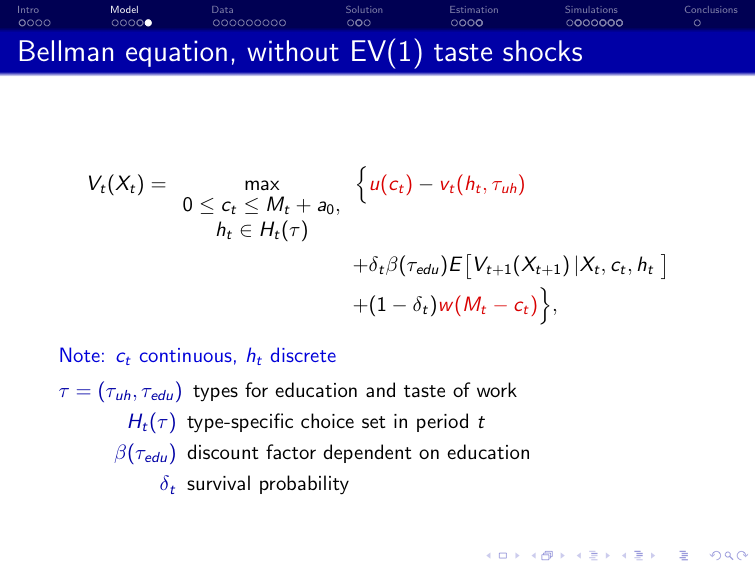

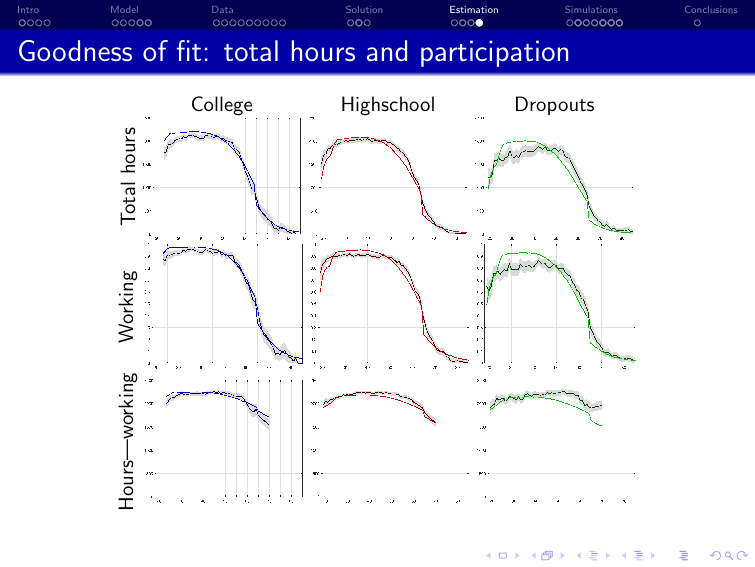

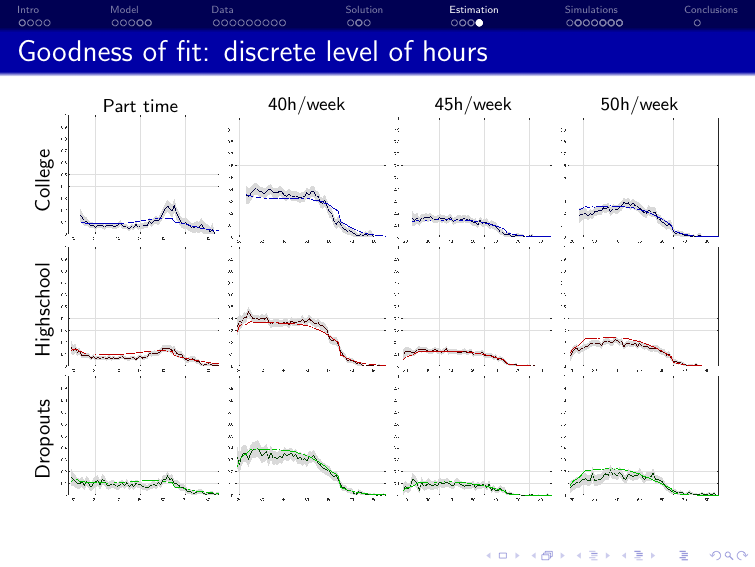

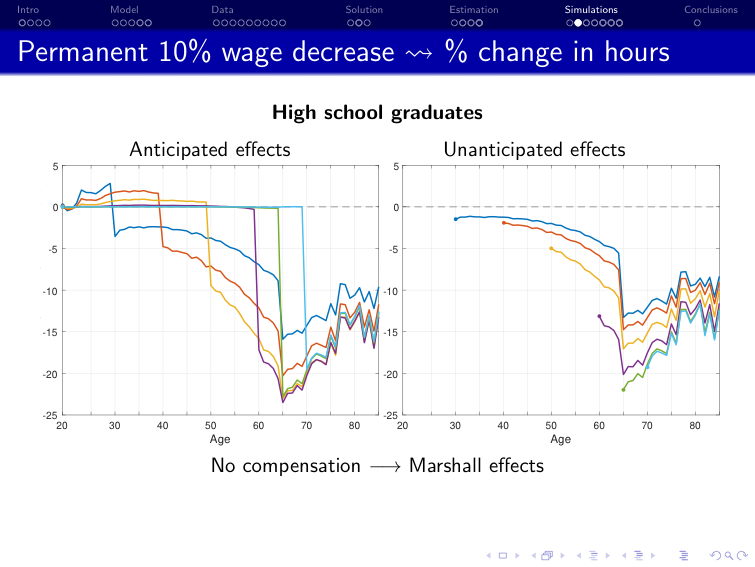

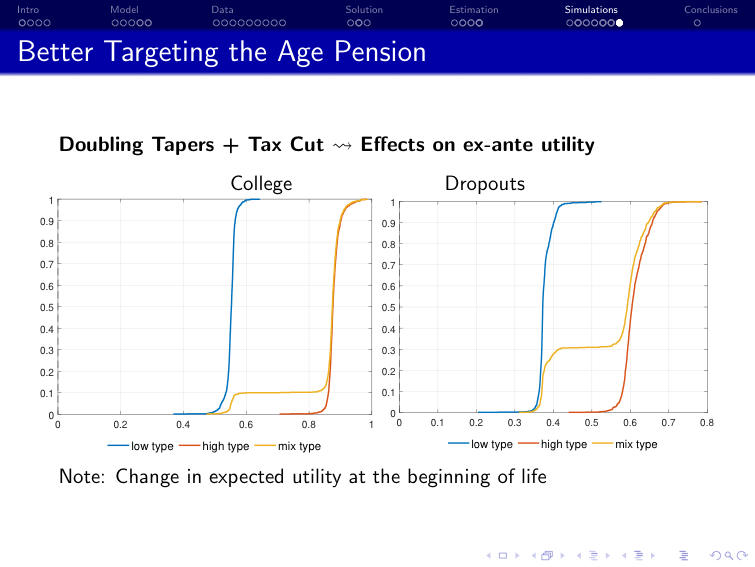

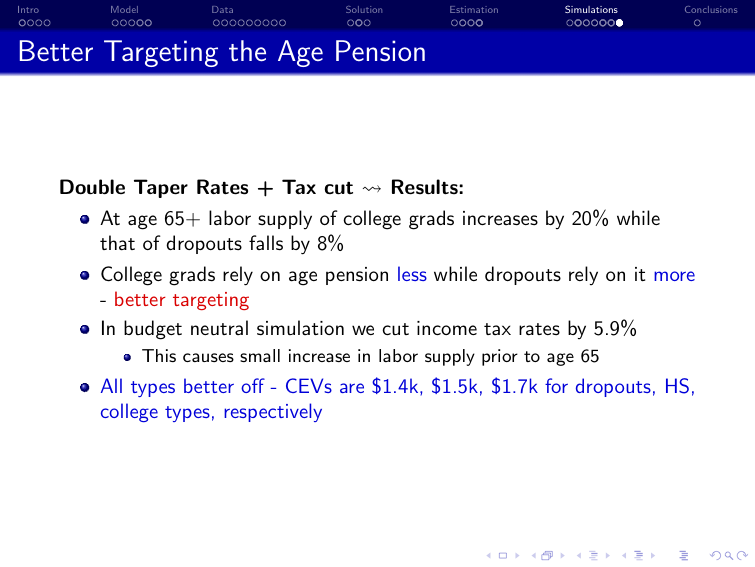

Example of EGM with MSM application in structural econometrics

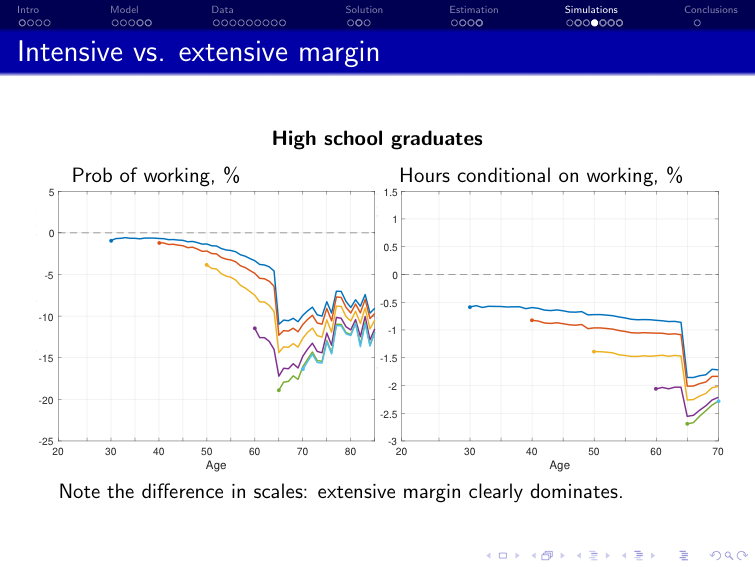

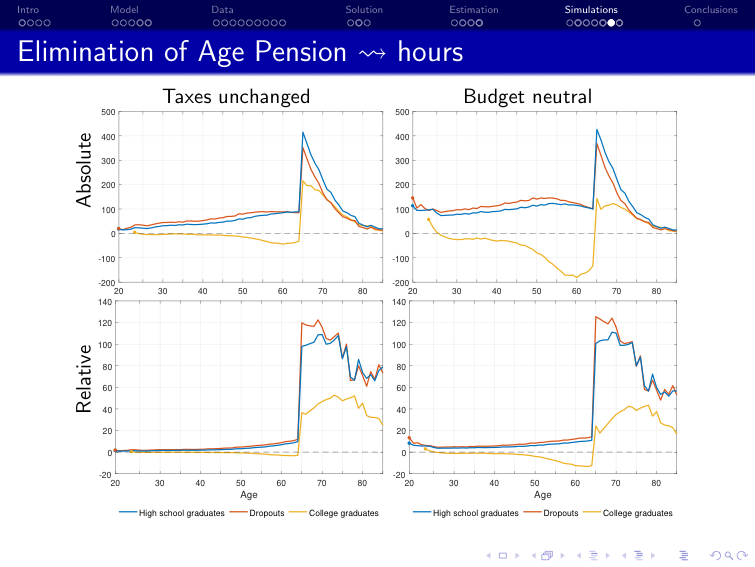

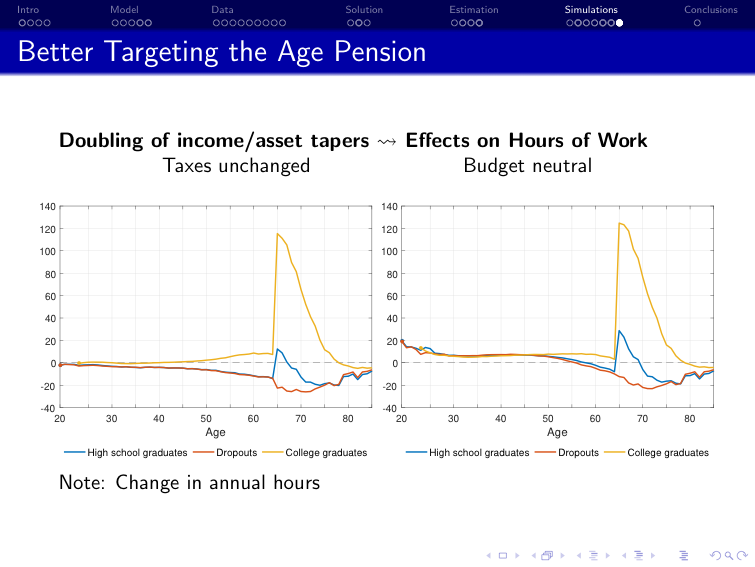

Iskhakov and Keane [2021] “Effects of taxes and safety net pensions on life-cycle labor supply, savings and human capital: The case of Australia”, Journal of Econometrics

Policy: retargeting of the pension system in Australia

Structural model: dynamic discrete choice model of labor supply, savings, and human capital

Equilibrium: none, partial equilibrium analysis with single decision maker (household)

Estimation: method of simulated moments using Australian survey data on labor supply and income (HILDA)

References and Additional Resources

📖 Iskhakov and Keane [2021] “Effects of taxes and safety net pensions on life-cycle labor supply, savings and human capital: The case of Australia”, Journal of Econometrics

📖 Adda and Cooper [2023] “Dynamic Economics” pp. 87-89

📖 McFadden [1989] “A Method of Simulated Moments for Estimation of Discrete Response Models Without Numerical Integration”, Econometrica

Youtube video lecture on MSM by Dean Corbae at DSE2024 summer school at the University of Wisconsin Madison https://youtu.be/61KXTkxZb3o?si=TGgQofH069u-7r0G

Notebook by Richard W Evans on MSM https://notes.quantecon.org/submission/5b3db2ceb9eab00015b89f93