📖 Introduction to structural estimation#

⏱ | words

Definition

Structural estimation refers to econometric methods that estimate parameters of economic models derived from economic theory, often involving optimization behavior by agents.

Historical overview#

Stage 1: Early Foundations (1930s–1950s)#

Hurwicz, Marschak, Haavelmo, Koopmans, Cowles Commission

Key contributions:

Introduced structural vs reduced form distinction.

Formalized simultaneous equations, endogeneity, identification.

Haavelmo (1944): probability approach to econometrics → modern estimation foundations.

Marschak: structure needed for policy analysis.

Hurwicz: identification theory (order/rank conditions).

Legacy: SEM becomes the dominant approach to causal inference in economics.

Stage 2: The Lucas Critique and Microfoundations (1970s)#

Robert Lucas and the Rational Expectations revolution

Key points:

Structural parameters must be policy invariant.

Ad hoc SEM (with “behavioral equations”) fail under policy changes.

Led to microfounded models derived from optimization and equilibrium conditions.

Birth of DSGE models as dynamic, expectations-driven SEM descendants.

Legacy: SEM concepts survive but become embedded inside microfounded dynamic systems.

Stage 3: Individual-Level Structural Modelling (1980s–1990s)#

Rust (1987): Dynamic discrete choice Hotz–Miller (1993): CCP inversion, reduced-form based identification Berry–Levinsohn–Pakes (1995): Random-coefficients demand estimation

Key innovations:

Microfoundations at the agent level (Bellman equations).

Structural estimation using NFXP and GMM.

Discrete choice demand becomes the IO workhorse.

Legacy: Structural microeconometrics becomes a major field.

Stage 4: Modern Structural IO (1990s–2020s)#

Ericson–Pakes (1995) \(\rightarrow\) dynamic games Aguirregabiria–Mira, Pakes et al., and more recent computational IO

Advances:

Multi-agent dynamic games, heterogeneous firms, entry/exit, investment.

GMM, simulation, and high-dimensional methods.

Close integration with industrial organization and antitrust practice.

Legacy: Modern IO is a fully microfounded, dynamic descendant of SEM.

From Classical SEM to Modern Structural Econometrics

+----------------------+

| Classical SEM |

| (Haavelmo–Marschak) |

+-----------+----------+

|

| Microfoundations + Dynamics

v

+----------------------+

| DSGE Models |

| (Dynamic SEM with |

| expectations & shocks)

+-----------+----------+

|

| Structural decision-making

v

+-----------------------+

| Dynamic Discrete |

| Choice Models (Rust) |

| Bellman eqns = system |

+-----------+-----------+

|

| Strategic interaction + heterogeneity

v

+-----------------------+

| Structural IO |

| (BLP, Ericson–Pakes) |

| Demand + Supply as |

| equilibrium systems |

+-----------------------+

Modern structural econometric models—DSGE, dynamic discrete choice, and structural IO—are dynamic, microfounded generalizations of classical simultaneous equations models (SEM).

Structural & reduced form econometrics#

Aspect |

Structural Econometrics |

Reduced Form Econometrics |

|---|---|---|

Definition |

Estimation of parameters of economic models derived from theory |

Estimation of relationships directly from the data |

Purpose |

Policy analysis, counterfactuals, understanding theoretical mechanisms |

Prediction, local causal inference |

Model |

Based on economic theory, optimization behavior |

Statistical relationships without explicit economic model |

Assumptions |

About details of economic behavior |

About statistical properties of data |

Identification |

Exclusion restrictions, instruments, functional form |

Often relies on natural experiments, IV, regression discontinuity |

Estimation Methods |

MLE, GMM, simulated methods |

OLS, IV, matching, regression discontinuity |

Data Requirements |

Often requires detailed microdata |

Generally less detailed or aggregate data |

Applications |

Structural models of demand, dynamic programming, games |

Reduced form impact evaluations, treatment effects |

Structural econometrics focuses on estimating parameters of economic models derived from theory, allowing for counterfactual analysis and policy simulations.

Reduced form econometrics focuses on estimating relationships directly from data without explicit reference to underlying economic models, often used for prediction or causal inference without structural interpretation.

Definition

Structural modeling is disciplined abstraction for counterfactual analysis.

Questions for discussion/reflection:

How can a complicated new and unique policy be evaluated without a model?

Should not model parameters be determined by the population under consideration?

Can a model be useful without being realistic? Are lab rats realistic representation of humans?

What does “realism” mean? Not accepting perceived conventionality?

Should not research challenge the conventionality by definition?

Why Structural Econometrics?#

Internal Consistency#

Rational agents facing constraints

Explicit uncertainty as probability distribution

Well-defined equilibrium concepts (competative, Nash, etc)

Explicit data-generating processes

Estimation grounded in LLN and CLT

Elegance and Transparency#

Steps can be independently verified

Limited discretion (though numerical implementation still may be subject to issues)

Causality#

A model-based concept of causality

Clear and explicit assumptions

Counterfactuals#

Generated by the model

Valid only within the maintained structure

Require external validity assumptions

Components of structural estimation project#

Economic model derived from economic theory

Microfoundations: optimizing agents (consumers, firms)

With bounded rationality and behavioral extensions

Potentially dynamic decision-making: intertemporal choices

Equilibrium conditions or partial equilibrium keeping certain things fixed

Heterogeneity of agents: observed and unobserved differences

Strategic interactions (games) or infinitely small agents (aggregate market states)

Data generated/described by the economic model

Cross-sectional, time series, or panel data

Individual-level or aggregate-level observations

Potentially censored, truncated, or missing data

Preliminary data analysis

Data cleaning and preparation

Descriptive statistics

Visualization

Reduced form estimation to reduce dimensionality

Feed back into the economic model development

Estimation method to recover structural parameters

Maximum likelihood (full information or limited information)

Generalized method of moments (GMM)

Simulated methods (e.g., simulated maximum likelihood, method of simulated moments)

Bayesian methods

Identification strategy

Exclusion restrictions: variables that affect some equations but not others

Functional form assumptions: parametric or semi-parametric structures

Instruments for endogenous variables (BLP)

Policy invariance assumptions

Counterfactual simulations

Use estimated structural parameters to simulate outcomes under different policies or scenarios

Estimated model is a synthetic laboratory, simulated world for policy analysis

Evaluate welfare effects, market outcomes, or behavioral responses

Conduct policy analysis based on the structural model

Prototype Dynamic Discrete Choice Model#

Choices#

Periods: \(t = 1, \dots, T\), possibly \(T = \infty\)

Actions: \(j = 1, \dots, J\)

Indicators: \(d_{jt} \in \{0,1\}\)

Mutual exclusivity is not restrictive: combinations can be redefined as distinct actions.

States and Transitions#

Let the state be \(z_t \in \mathcal{Z}\). This is all the information that is relevant for the decision at time \(t\).

Transition probabilities when action \(j\) is chosen at period \(t\)

State spaces may be large but are often sparse.

Preferences and Expected Utility#

Flow/current/instantaneous utility at time period \(t\) when action \(j\) is chosen

Discount factor

Expected utility

Value Functions and Bellman Equation#

Define the optimal policy \(d_t^\star(z_t)\) as vector of zeros and one indicating the most desirable action.

Value function = conditioning on optimal behavior in all future periods = maximal attainable expected utility from period

Bellman equation:

We will later see how Bellman equation can be solved and value functions computed numerically

Define choice-specific value:

By definition the optimal choice is:

Why Unobserved Heterogeneity Is Needed#

If agents with identical observed states are observed in the data to choose differently

The model implies indifference between actions

All actions appear optimal

The model loses empirical content!

Therefore fully observed heterogeneity is useless for data analysis.

Unobserved Heterogeneity Framework#

Decompose the state:

\(x_t\): observed by both agents and econometrician

\(e_t\): unobserved by econometrician, but observed by agents

The objective becomes predicting choice probabilities, not individual choices.

Data Generating Process#

Observed data are states and corresponding choices:

with the individual observations given by

Likelihood integrates out unobservables:

Huge multidimensional integral in general case!

We will see how Rust assumptions simplify this drastically

Maximum Likelihood Estimation#

Let \(\theta\) index utilities, transitions, and \(\beta\).

Early applications include Miller (1984) and Wolpin (1984).

Other estimation approaches:

Two-step methods based on conditional choice probabilities estimated directly from the data (CCP methods) (Hotz–Miller, Aguirregabiria–Mira)

GMM

Method of simulated moments (MSM)

Calibration (no standard errors)

Multiple decision makers \(\rightarrow\) equilibrium models#

Macro style models with aggregate states#

Infinitely many agents

Individual actions do not affect aggregate states

Aggregate states affect individual payoffs and transitions

Aggregate states evolve according collective behavior of all of the agents

Dynamic Markov Games#

Finite number of agents

Individual actions affect payoffs and transitions of all other agents

Joint individual actions affect payoffs and transitions

Equilibrium defined by mutual best responses

Nash

Bayesian Nash

Markov Perfect Equilibrium (MPE)

Oblivious equilibrium, etc.

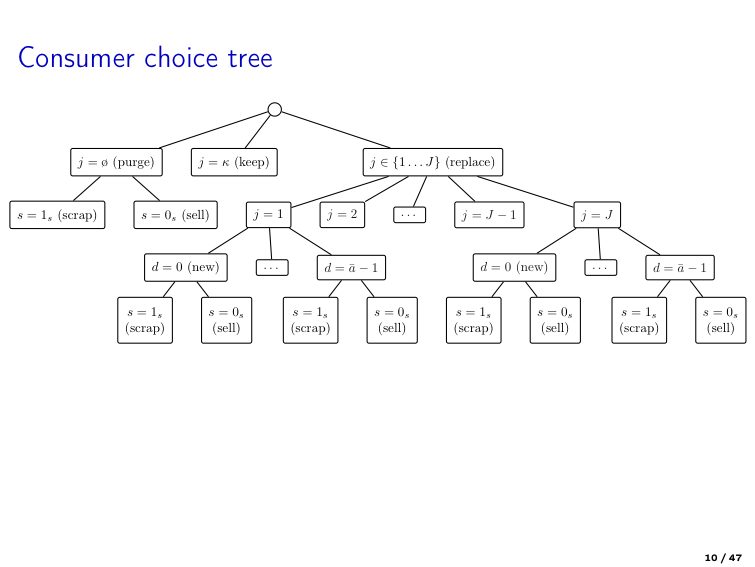

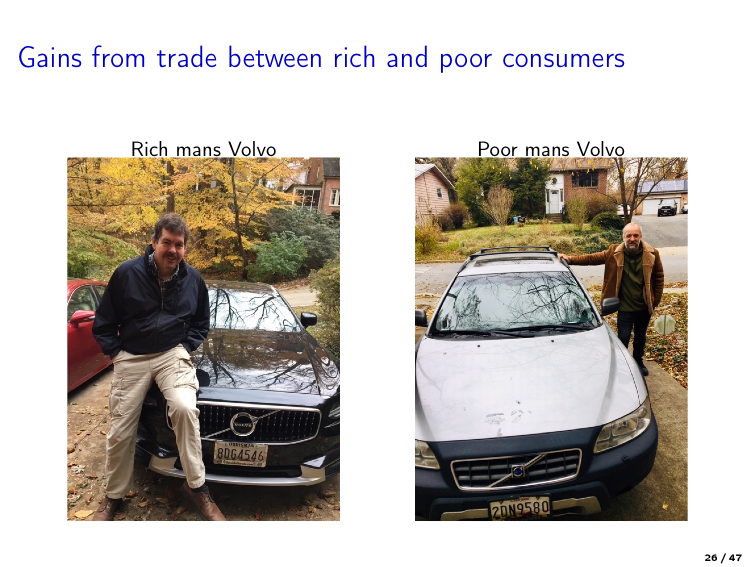

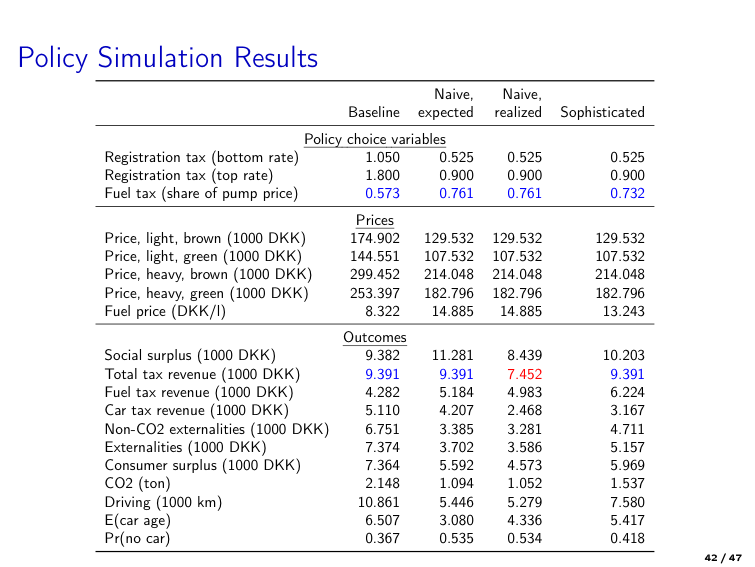

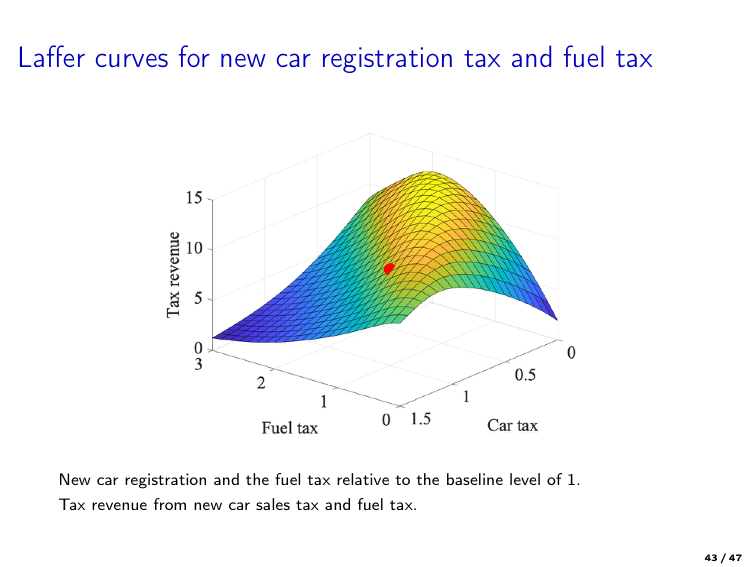

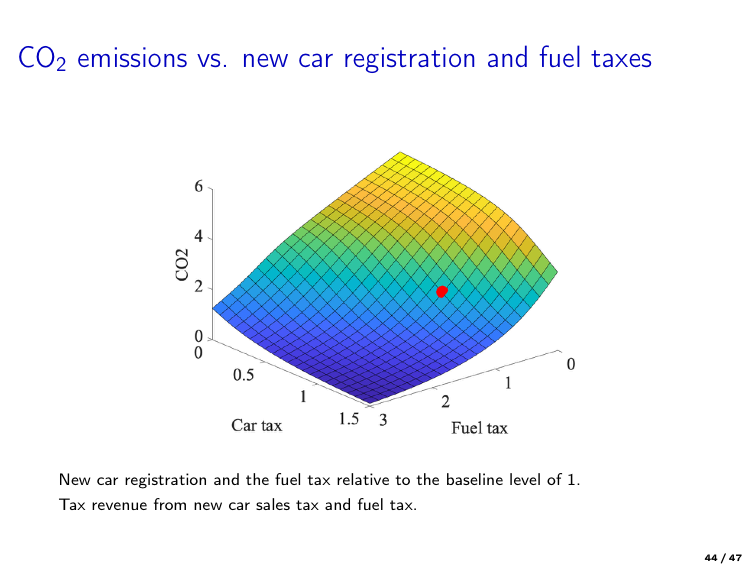

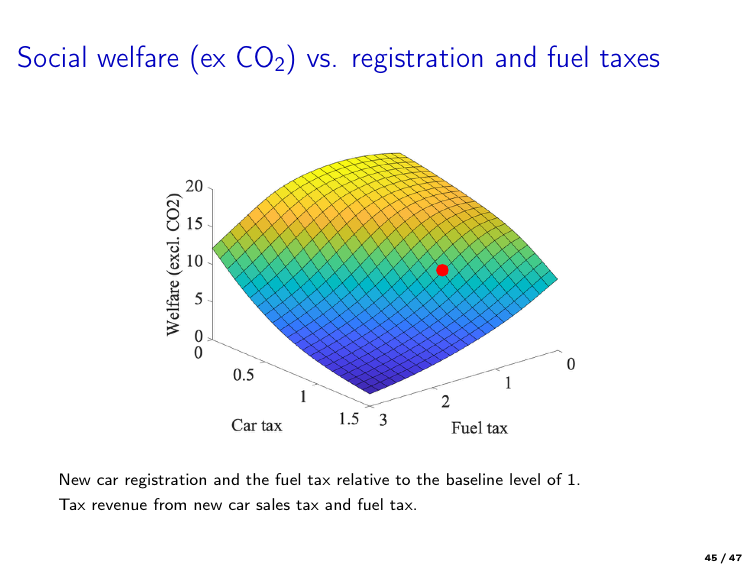

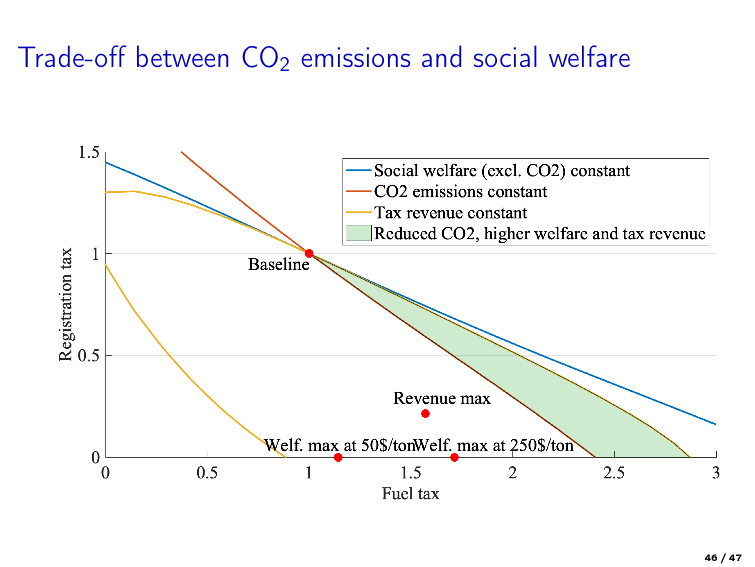

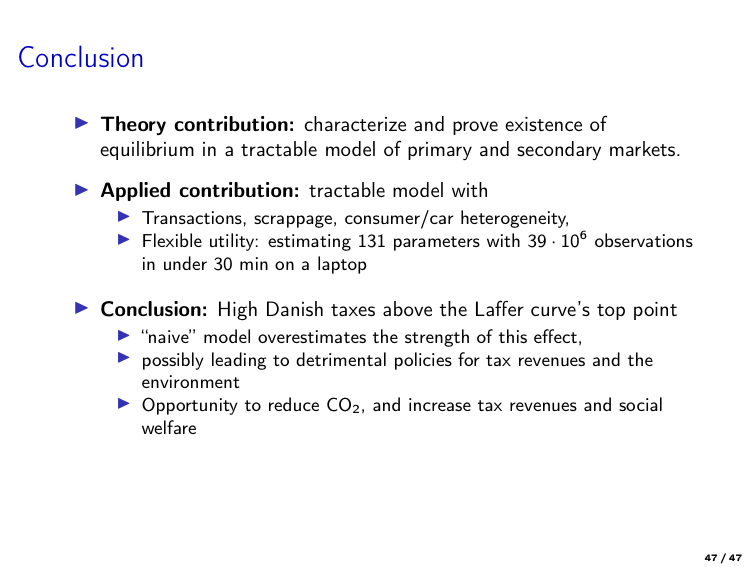

Example of policy analysis based on structural estimation

Gillingham et al. [2022] “Equilibrium Trade in Automobiles,” Journal of Political Economy

Policy: restructuring of car registration and fuel taxes in Denmark

Structural model: dynamic discrete choice model of car ownership and usage

Equilibrium: used car prices adjust to balance supply and demand in the secondary market

Estimation: MLE using Danish register data on car ownership and usage

References and Additional Resources

📖 “Economic Theory and Measurement: A Twenty Year Research Report, 1932–1952” report by Cowles Commission, University of Chicago, 1952

Download pdf📖 Keane [2010] “Structural vs. atheoretic approaches to econometrics”, Journal of Econometrics

📖 Wolpin [2013] “The Limits of Inference without Theory”, The MIT Press

📖 Rust [2014] “The Limits of Inference Theory: A Review of Wolpin (2013)”, Journal of Economic Literature

📖 Sargent [2024] “Critique and consequence”, Journal of Monetary Economics 2024

Michael Keane’s lecture on structural estimation at BFI at the University of Chicago https://youtu.be/0hazaPBAYWE